free cash flow yield explained

To break it down free cash flow. Generally firms with strong cash flows are financially healthy as.

Free Cash Flow Yield Fcfy Formula Examples Calculation Youtube

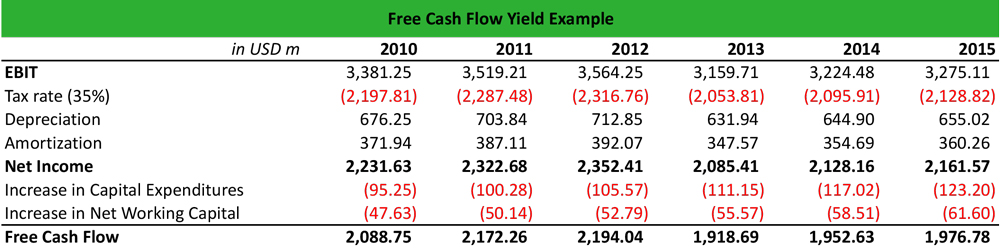

Step 1 Cash Flow from Operations.

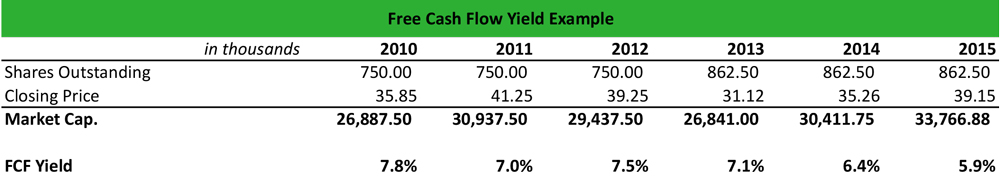

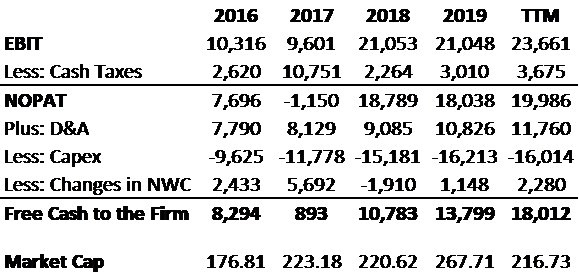

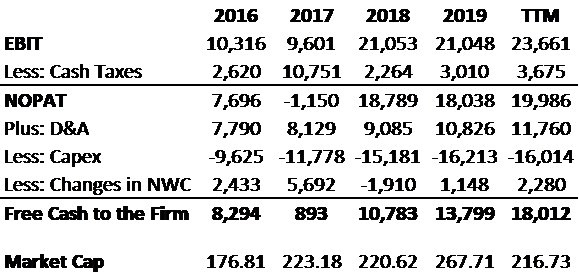

. The completed model output is shown below. Free cash flow yield FCFY is a ratio used to work out the cash flow return on a share as a percentage. Free Cash Flow Yield - Michael Mack Portfolio Manager.

Cash may be King but FCF yield is an Ace. Heres the fun part. Diversify your portfolio by investing in art real estate legal and more asset classes.

Free Cash Flow Yield Free Cash Flow Market Capitalization. Since this measure uses free cash flow. Return On Tangible Equity.

Free Cash Flow Yield FCFY We can take this relevant information and produce a ratio that is one of the most useful metrics in stock analysis. Calculate FCF for the year of 2008. Diversify your portfolio by investing in art real estate legal and more asset classes.

Httpsamznto35cbAn0Fundsmith founder Terry Smith explains free cash-flow yield. What is the definition of free cash flow yield. Free Cash Flow Yield Free Cash Flow Market Capitalization.

People sometimes describe this as free cash flow yield Cash on Cash Yield is a different measurement often used to. Cash flow from operations is the total of net income and non-cash expenses like Depreciation Depreciation. HSBC Offers A Range Of Solutions To Help You Gain More Control Over Your Cash Flow.

The levered FCF yield comes out to 51 which is roughly 41 less than the unlevered FCF yield of 92 due to the debt obligations of the. Ad Yieldstreet is an investor-first platform offering income-generating products. Free cash flow yield is really just the companys free cash flow divided by its market value.

Httpsamznto3LGhEoHMy favorite Investment Book. It is mechanically similar to thinking about the dividend or earnings yield of a stock. This ratio expresses the percentage of money left over for shareholders compared to the price of the.

In this weeks short video I explain how it works. Free Cash Flow To Equity FCFE caters only to the equity holders. Free Cash Flow Yield.

Free Cash Flow FCF is a financial performance calculation that measures how much operating cash flows exceed capital expenditures. Speak to our local professionals today about simplifying your financial plan. Ad Download our toolkit to learn how to forecast cash flow statements even in uncertain times.

Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share. Formula 2 FCFF Free cash flow yield calculation from a firms perspective equity holders preferred shareholders and debt holders is as follows. Ad Browse Discover Thousands of Business Investing Book Titles for Less.

To break it down free cash flow. Valuation metrics offer investors a simple way to assess a companys worth by looking at its sales earnings and cash flow. It shows the cash that a company can produce after deducting the purchase of assets such as property equipment.

Free Cash Flow Yield measures the amount of cash flow that an investor will be entitled to. FCF is a useful valuation metric to determine a firms operating performance. And machine learning models to help you maximize your working capital performance.

Though the company looks profitable in the. In other words it measures how much. Free Cash Flow Yield Explained.

Free cash flow FCF is the owners net cash income generated by a company after adjusting for all non-cash transactions new debt and Capex. Ad Optimize cash shore up your capital position extend your runway for business resilience. Free cash flow FCF measures a companys financial performance.

Called the free cash flow yield this gives investors another way to assess the value of a company that is comparable to the PE ratio. Free Cash Flow Yield Explained. Ad We bring in the right mix of our industry and functional expertise with data analytics AI.

Based on whether an unlevered or levered cash flow metric is used the free. The free cash flow yield FCFY is a financial solvency metric that compares a companys predicted free cash flow per share to its market value per share. Thats the ratio of free cash flow to market cap.

Free cash flow yield is widely quoted by analysts and gives investors a useful insight into whether a share is cheap or expensive. Get driver-based cash flow forecasting and scenario analysis to fit your requirements. Ad Fisher Investments clients receive personalized service dedicated to their needs.

Free Cash Flow is an important metric but the level of FCF by itself does not provide enough information for an investment. FCFY Free cash flow to firm FCFF. Mechanically if free cash flow is say 100m and the firms market.

Reduce Debt And Enhance Your Balance Sheet. The calculation of free cash flow yield is fairly simple. Ad Yieldstreet is an investor-first platform offering income-generating products.

Forecast your future cash position and regain your control on your business finances. When using discounted cash flow analysis 205 of analysts use a residual income approach 351 use a dividend discount model and 869 use a discounted free cash flow model. Ad Manage Cash Flows More Efficiently.

Free Cash Flow Yield Free.

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Unlevered Free Cash Flow Definition Examples Formula

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Meaning Examples What Is Fcf In Valuation

Free Cash Flow Fcf Formula Calculation Types Getmoneyrich

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow Yield Formula Top Example Fcfy Calculation

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Fcf Yield Unlevered Vs Levered Formula And Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

What Is Free Cash Flow Yield Definition Meaning Example

Free Cash Flow To Equity Fcfe Levered Fcf Formula And Excel Calculator

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth