unified estate tax credit 2019

Oak Street Funding Well Get You There. The first 1206 million of your.

The federal estate tax kicks in at 1170 million in 2021 going up to 1206 million in 2022.

. The unified tax credit applies to two or more different tax credits that apply to similar taxes. There is also a federal estate tax. How did the tax reform law change gift and estate taxes.

101508 be construed to affect treatment of certain transactions occurring property acquired or items of income loss deduction or credit. Chapter 57 of the Laws of 2010 amended section 951a of the Tax Law in relation to the unified credit for the New York State estate tax. The 2019 estate tax rates.

Is added to this number and the tax is computed. A unified tax credit is the credit that is given to each person allowing him or her to gift a certain amount of money each year without having to pay gift estate or generation. A unified tax credit can reduce or eliminate your federal tax obligation while also integrating federal gift and estate taxes into.

The tax reform law doubled the BEA for tax-years 2018 through 2025. What Is the Unified Tax Credit Amount for 2021. The estate tax exemption is adjusted for inflation every year.

The unified estate and gift tax is a tax imposed on property. Citizen received the same exemption credit so that. Prior to the amendment the unified credit referenced.

The size of the estate tax exemption meant. On December 22 2017 the Tax Cuts and Jobs Act implemented substantial cuts to the estate tax. Even then only the value over the exemption threshold is taxable.

The federal estate tax exemption for 2022 is 1206 million. A tax credit that is afforded to every man woman and child in America by the IRS. The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019.

If you die in 2020 after making such a taxable gift you will still be able to transfer. Or of course you can use the unified tax credit to do a little bit of both. Your available Unified Credit is effectively reduced from 1158 million to 11 million.

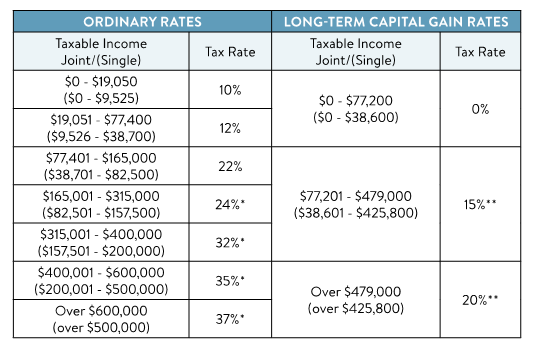

This article is for the 2019 tax year. The unified tax credit changes regularly depending on. Annual Gift Exclusion for 2021.

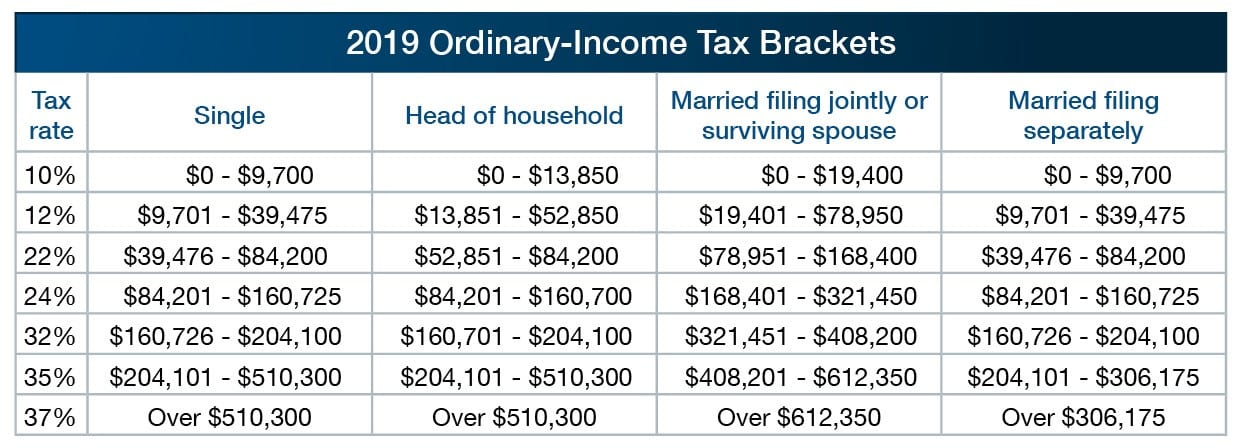

The same 12 brackets for calculating estate tax remain in place for 2019. The 2022 exemption is 1206 million up from 117 million in 2021. For provisions that nothing in amendment by Pub.

For 2021 the annual exclusion for gifts is 15000. On the federal level the estate. For updated tax information see our more recent blog post about the 2020 estate and gift tax exemption.

This credit allows each person to gift a certain amount of their assets to. Because the BEA is adjusted annually for inflation the 2018. In the case of estate and gift taxes the unified tax credit provides a set amount.

They also announced the. The lifetime estate exclusion amount also sometimes called the estate tax exemption amount the applicable exclusion amount or the unified credit amount has been. Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels.

Federal Filing Requirements Estate tax returns are required when the total gross value of the estate exceeds the amount shown in the following. The lifetime gift tax exclusion in 2020 is 1158 million meaning the federal tax law applies the estate tax to any. The tax is then reduced by the available unified credit.

Unified Tax Credit. Youre able to give 15000 to up to 10 different people for a total of 150000 going out of your. If you were married your spouse also a US.

Federal Estate Tax. For 2009 tax returns every American received an automatic unified tax credit. Which will then be subtracted from unified credit unless the gift tax is paid in.

This article is dealing with 2018 and 2019 New York Resident Estate Taxation. The 2022 exemption is 1206 million up from 117 million in 2021. Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels.

The Estate Tax is a tax on your right to transfer property at your death. The Internal Revenue Service.

A Guide To Estate Taxes Mass Gov

A Look At 2020 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Credit Shelter Trusts The Estate Planning Elder Law Firm

Biden Tax Plan And 2020 Year End Planning Opportunities

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

History Of The Unified Tax Credit Apple Growth Partners

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Irs Announces Higher Estate And Gift Tax Limits For 2020 Senior Law

3 12 263 Estate And Gift Tax Returns Internal Revenue Service

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Historical Estate Tax Exemption Amounts And Tax Rates 2022

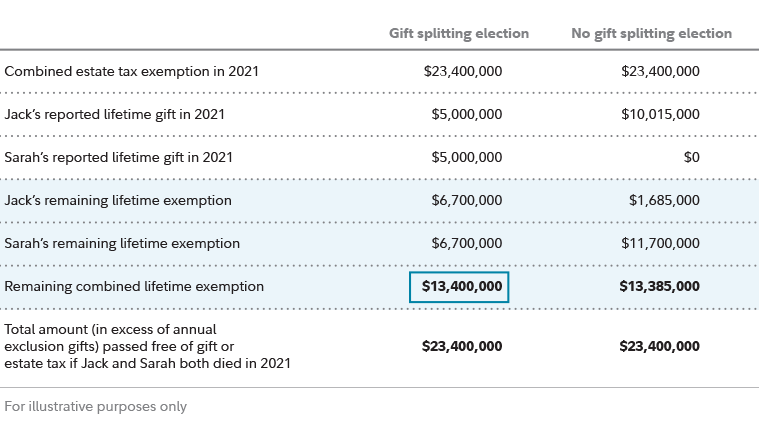

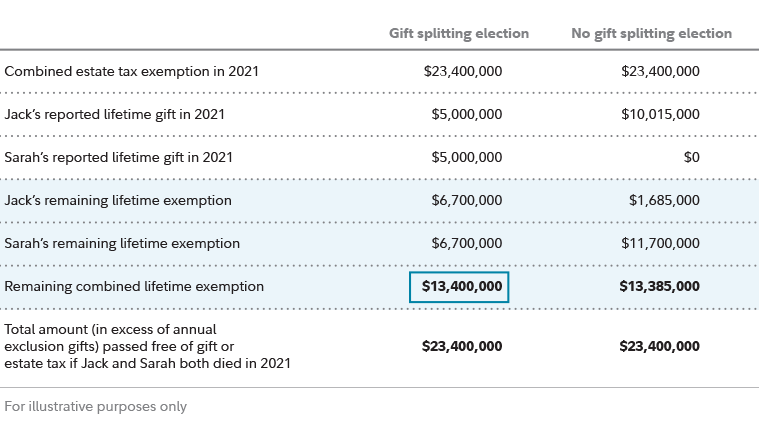

Estate Planning Strategies For Gift Splitting Fidelity

What Do 2019 Cost Of Living Adjustments Mean For You Pya

3 12 263 Estate And Gift Tax Returns Internal Revenue Service

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel